Ekta Mourya

FXStreet

Shiba Inu, a Dogecoin-killer meme coin, is being scooped up by large wallet investors on the Ethereum network. Whales have accumulated SHIB tokens consistently since 2022. Despite demand from whales, the cryptocurrency is stuck in a tight range and 90% away from its all-time high.

Also read: Ethereum prepares for Shanghai hard fork in March 2023, will ETH crumble under selling pressure

Ethereum network’s large wallet investors scoop up the meme coin consistently through dips in SHIB’s price. This started in mid-2022 and continued throughout the second half of the year. The Dogecoin-killer is currently 90% away from its all-time high.

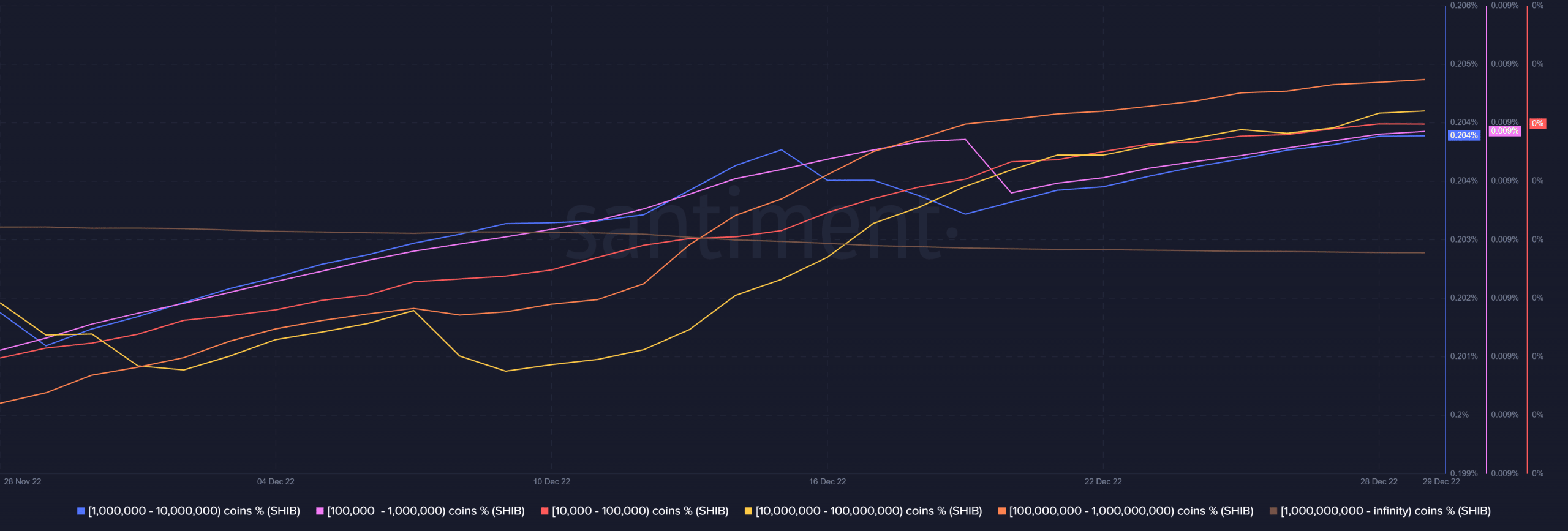

SHIB accumulation by whales

Shiba Inu is the second largest cryptocurrency by market capitalization after Dogecoin. Despite rising demand from whales, the dog-themed meme coin has failed to wipe out losses from crypto winter.

On close observation, the accumulation by whales reveals that retail participation is low, and institutions and professional traders are scooping up SHIB in the current price range. There needs to be more participation from retail, as sentiment among traders remains bearish.

Shiba Inu price was stuck within a tight price range after mid-December and continued to slip lower in 2023. The decline in SHIB has brought the meme coin close to a critical support level at $0.0000081. Shiba Inu price was within this range at the bottom of the June 2022 crash.

Data from crypto intelligence tracker Whalestats confirmed that SHIB features on the list of top 10 most traded tokens among the 100 largest whales on the Ethereum network. This confirms a rising demand for the Dogecoin-killer above the support level.

JUST IN: $SHIB @Shibtoken now on top 10 purchased tokens among 2000 biggest #ETH whales in the last 24hrs

Peep the top 100 whales here: https://t.co/R19lKnPlsK

(and hodl $BBW to see data for the top 2000!)#SHIB #whalestats #babywhale #BBW pic.twitter.com/ERo2CK30RN

Shiba Inu needs market-wide participation from retail traders to wipe out losses from crypto winter and the spreading of FTX contagion.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin (BTC) price shows a clear surge in buying pressure that has shifted the landscape from bearish to bullish, albeit for the short term. Regardless, investors are cautious and torn between discerning what phase of the cycle BTC is in.

Stablecoins have seen a shift in their activity level and general sentiment has fallen alongside prices, despite a spike in demand and utilization. Tether (USDT), the largest stablecoin by market capitalization witnessed a decline.

Cardano (ADA) price is set to tank over 10% as pressure mounts on a crucial support level that is key to keeping this rally going. Lower highs are generated for a fifth day in a row, revealing a massive squeeze to the downside.

Solana, an Ethereum alternative blockchain, has witnessed a spike in the daily active SOL accounts and transactions on its network. The altcoin is working on dissociating itself from the FTX exchange collapse and “Sam coin” narrative.

Bitcoin (BTC) price shows a clear surge in buying pressure that has shifted the landscape from bearish to bullish, albeit for the short term. Regardless, investors are cautious and torn between discerning what phase of the cycle BTC is in.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.