![]() Ekta Mourya

Ekta Mourya

FXStreet

Ethereum, the second largest cryptocurrency by market capitalization, witnessed massive growth in its ecosystem despite deflation in risk assets in 2022. Bloomberg strategists believe the altcoin is set to outshine the largest cryptocurrency, Bitcoin, in 2023.

Also read: Bitcoin and stablecoin whales scoop up BTC, USDT, BUSD and DAI: Recipe for crypto Santa Claus rally

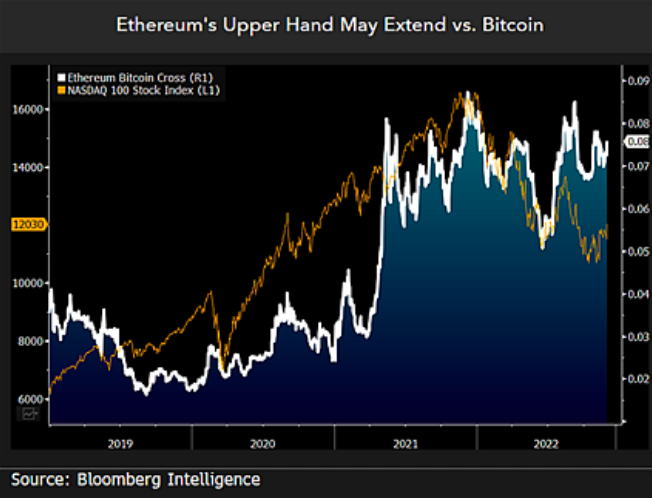

Ethereum, the largest altcoin by market capitalization and the second-largest cryptocurrency, is competing with Bitcoin for dominance. Strategists at Bloomberg noted that Ethereum price increased consistently against Bitcoin, despite the bear market.

Mike McGlone, Senior Commodity Strategist at Bloomberg, believes Ethereum is the strongest contender to Bitcoin as ETH’s advances versus Bitcoin are unshaken. The Ethereum/Bitcoin (ETH/BTC) cross rate is 0.08, nearly the same as May 2021 when the Nasdaq 100 stock index was 20% higher. The annual volatility of Ethereum is nearly 1.3 times that of Bitcoin.

Ethereum is expected to outperform Bitcoin in 2023

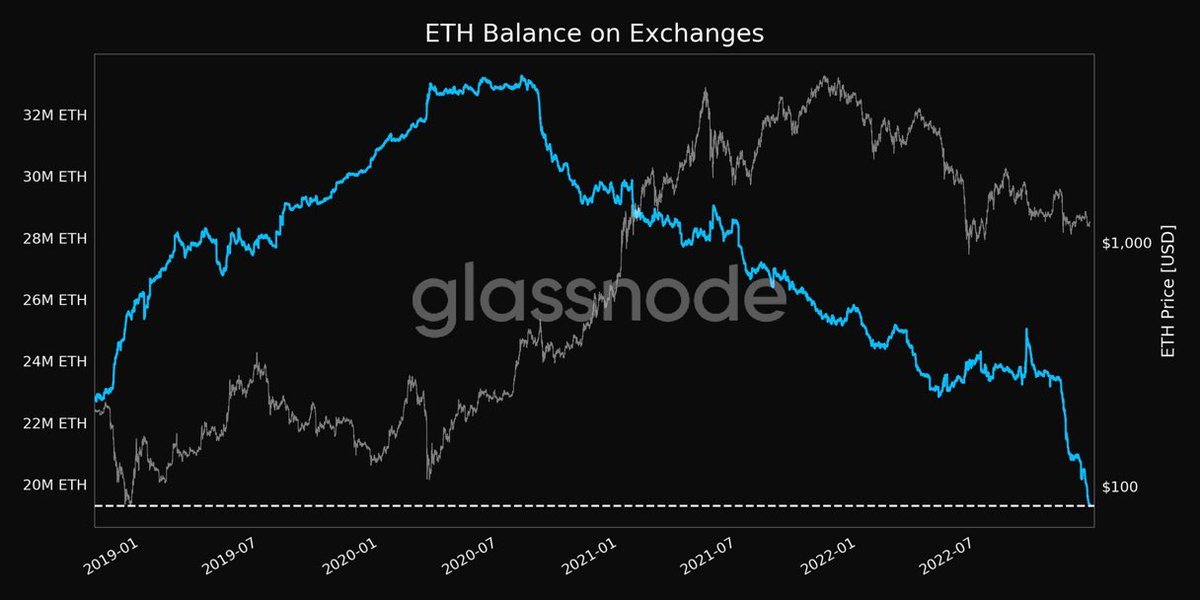

Interestingly, the selling pressure on Ethereum has decreased as the ETH balances on exchanges declined throughout 2022. ETH exchange balance recently hit a four-month low, according to data from CryptoQuant.

ETH balance on exchanges

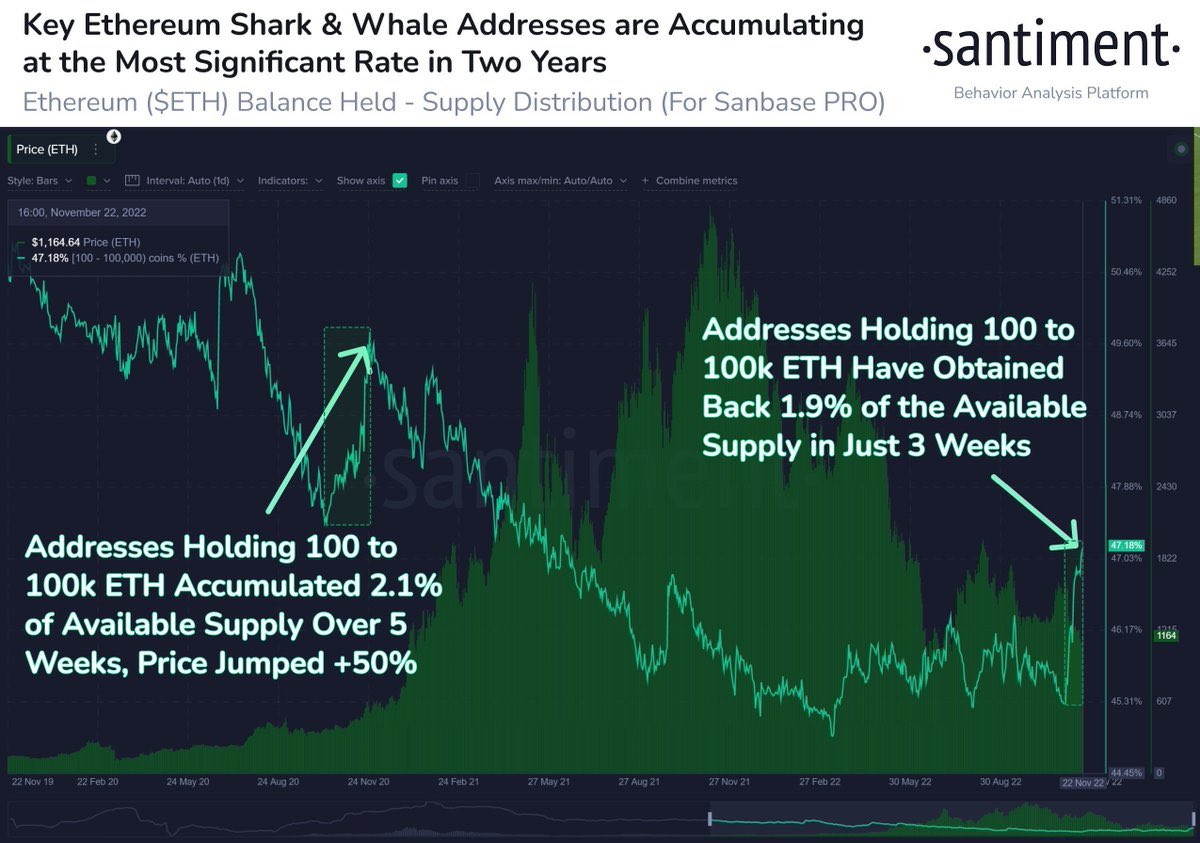

Large wallet investors on the Ethereum network scooped up the altcoin at the fastest rate in history in W4 of November 2022. Based on data from CryptoQuant, key Ethereum whale addresses holding between 100 and 100,000 ETH tokens scooped up 2% of the total supply within three weeks in November 2022.

Key Ethereum sharks and whales accumulated ETH tokens

One of the key factors contributing to the altcoin network’s unprecedented growth against Bitcoin is the massive spike in transactions. In the last two months, ETH layer-1 and layer-2 together processed 152 million transactions of which layer-2 solutions Arbitrum, Optimism and others accounted for 58%.

The last two months have been special for #Layer2 in terms of activity.

Both layers of Ethereum processed a total of over 152 million transactions, 58% of which happened on L2. @arbitrum and @optimismFND combined are also becoming close to flipping Layer 1 daily transactions. pic.twitter.com/ohKUzy01rr

Analysts evaluated the Ethereum price trend and have predicted a bullish breakout in ETH. The altcoin is currently changing hands at $1,212 and analysts believe the asset has the potential to hit $1,286.

ETH/USDT price chart

In the chart above, technical analyst Phoenix_Ash3s predicts a rally in ETH. The expert believes ETH could climb higher crossing resistances at $1,238 and $1,270.

A decline to the 61.8% Fibonacci extension level at $1,177.41 could invalidate the bullish thesis for the asset’s price.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Ethereum whales continued their accumulation of Shiba Inu, the second-largest meme coin in the ecosystem. Shiba Inu (SHIB) ranks in the top ten most traded cryptocurrencies among 100 largest whales on the Ethereum blockchain.

The release of the latest US Producer Price Index (PPI) data, which measures factory gate price inflation, could significantly impact Bitcoin, Ethereum and other cryptocurrencies when it is released at 13:30 GMT on Wednesday, January 18.

A brief technical and on-chain analysis on Ripple price. Here, FXStreet's analysts evaluate where XRP could be heading next.

Ethereum price shows a clear sign of slowing down as it heads into a supply zone. Although there is a slow climb to the upside, the chances of a further continuation are very low.

BTC looks healthy and ready to retest one of the significant hurdles at $19,248. Network activity shows enthusiasm, but on-chain metrics reveal this move cannot sustain. Two key levels to pay attention to include $19,248 to the upside and $15,443 to the downside.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.