An official website of the United States government

Here’s how you know

The .gov means it’s official.

Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure.

The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

Make smart shopping decisions, know your rights, and solve problems when you shop or donate to charity.

View Shopping and Donating

View all Consumer Alerts

Get Consumer Alerts

Learn about getting and using credit, borrowing money, and managing debt.

View Credit, Loans, and Debt

View all Consumer Alerts

Get Consumer Alerts

What to know when you’re looking for a job or more education, or considering a money-making opportunity or investment.

View Jobs and Making Money

View all Consumer Alerts

Get Consumer Alerts

What to do about unwanted calls, emails, and text messages that can be annoying, might be illegal, and are probably scams.

View Unwanted Calls, Emails, and Texts

View all Consumer Alerts

Get Consumer Alerts

How to protect your personal information and privacy, stay safe online, and help your kids do the same.

View Identity Theft and Online Security

View all Consumer Alerts

Get Consumer Alerts

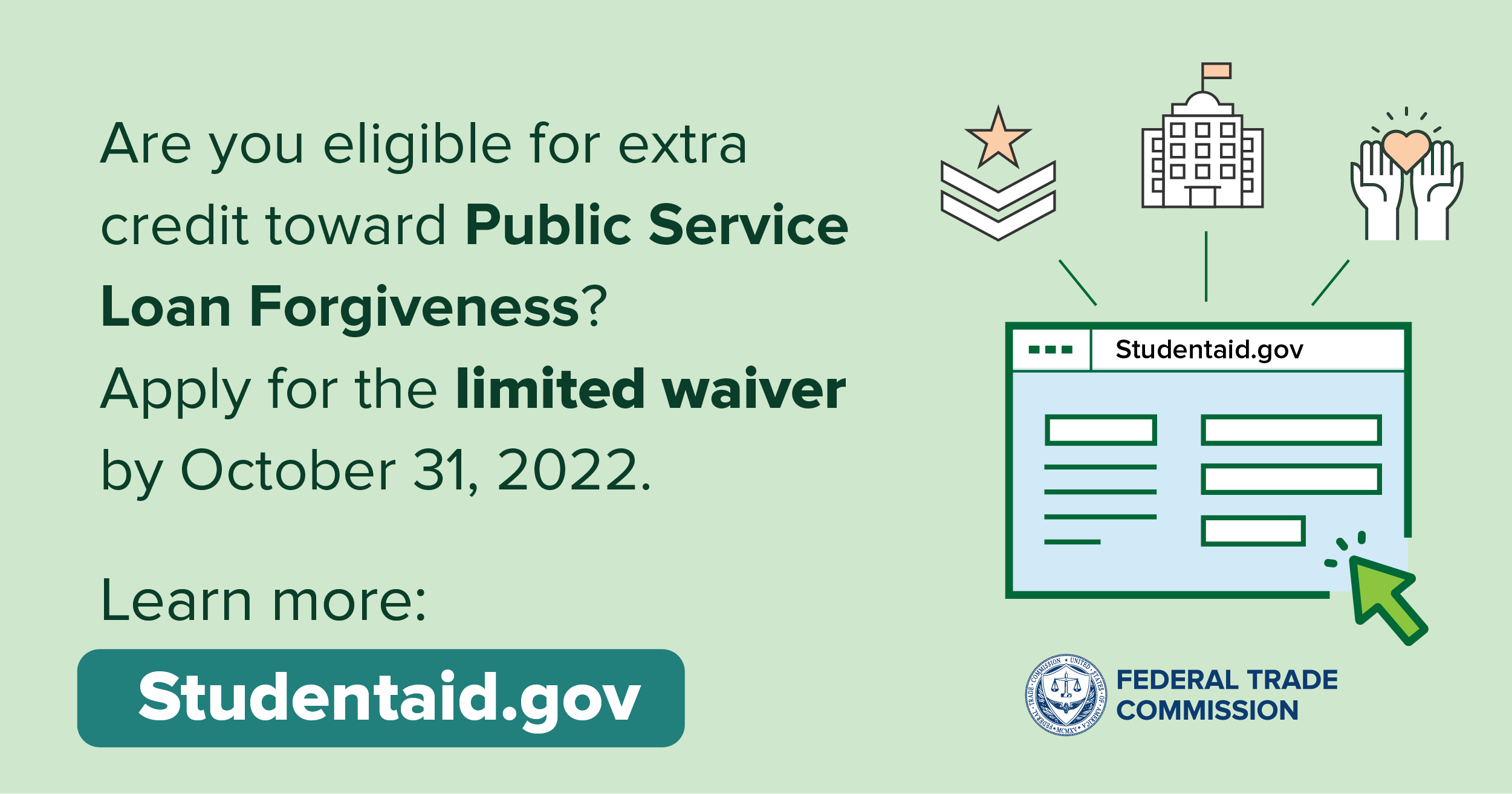

Do you have federal student loans? Have you worked in public service (for a government agency, the military, or a non-profit organization)? If so, find out whether you’re eligible for the Public Service Loan Forgiveness (PSLF) Limited Waiver, which expires on October 31, 2022. Thousands of federal student loan borrowers have used the waiver to get closer to total loan forgiveness.

The PSLF waiver might work for you if you have:

For a limited time, the waiver gives you credit for repayment periods that previously wouldn’t have counted — times when you didn’t make a payment, didn’t make it on time, didn’t pay the full amount due, or weren’t on a qualifying repayment plan.

With the average borrower getting a year’s worth of credit with the waiver, now’s the time find out if the PSLF waiver could work for you. Before October 31, 2022:

Always contact Federal Student Aid or your loan servicer with questions about loan repayment. And if a company says they can help you sign up for PSLF or any student loan forgiveness program for an advanced fee, it’s a scam! Report it to the FTC at ReportFraud.ftc.gov.

It is your choice whether to submit a comment. If you do, you must create a user name, or we will not post your comment. The Federal Trade Commission Act authorizes this information collection for purposes of managing online comments. Comments and user names are part of the Federal Trade Commission’s (FTC) public records system, and user names also are part of the FTC’s computer user records system. We may routinely use these records as described in the FTC’s Privacy Act system notices. For more information on how the FTC handles information that we collect, please read our privacy policy.

The purpose of this blog and its comments section is to inform readers about Federal Trade Commission activity, and share information to help them avoid, report, and recover from fraud, scams, and bad business practices. Your thoughts, ideas, and concerns are welcome, and we encourage comments. But keep in mind, this is a moderated blog. We review all comments before they are posted, and we won’t post comments that don’t comply with our commenting policy. We expect commenters to treat each other and the blog writers with respect.

We don’t edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain. To protect your privacy and the privacy of other people, please do not include personal information. Opinions in comments that appear in this blog belong to the individuals who expressed them. They do not belong to or represent views of the Federal Trade Commission.

Many of these news articles do not address the problem with the PSLF waiver and Parent Plus Loans. If you work in public service, and have your own loans and parent plus loans you can consolidate those loans and the PSLF waiver will be applied and you will get loan forgiveness after making 120 payments

However if you are in public service and took out parent plus loans only, and do not have a personal loan for your own education, or previously consolidated your loans you are not eligible for the PSLF waiver, regardless of number of years of years you worked in public service, or how many payments you have made. So, some parent plus loans are eligible for the PSLF waiver, and others or not even though both borrowers have made over 120 payments and worked in public service during the time those payments were made. There are a number of bills pending that are addressing this unfairness, and I hope those bills get the support needed to make all parent plus loans, not just some eligible for the PSLF waiver for borrowers who have devoted their lives to public service.

I was under the impression, or perhaps had just heard from somewhere else, so I can’t say this is 100% accurate, that if you had been unemployed or had been working as a home caregiver for a loved one, not receiving payment, that you could file for a student loan forgiveness. Did I just hear that wrong or is there somewhere that one can ask for a student loan forgiveness, if you were not working in government or non-profit? Something besides under the rule that the school did something wrong, which mine did not, it is just a matter of a loved one needing my help and not being able to afford or be able to stay at home were I not here. Just thought it was worth the ask. Thanks

More

Más